Our Savings Account. Flexible savings for flexible savers

Put away what you have, when you have it, with no restrictions or hoops to jump through.

Put away what you have, when you have it, with no restrictions or hoops to jump through.

| Account Name | Savings Account | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| What is the interest rate? | Current Rate

Interest is calculated daily and credited monthly. |

||||||||||||

| Can first direct change the interest rate? | Yes, we can change the interest rate on this account in line with the account's Terms and Conditions. |

||||||||||||

| What would the estimated balance be after 12 months based on a £1,000 deposit? | The estimated balance after 12 months would be as follows:

The estimated balance after 12 months based on a £1,000 deposit would be as follows, based on interest rates effective from 27 January 2025:

For the purpose of this calculation it is assumed:-

Projection provided for illustrative purposes only and does not take into account individual circumstances. |

||||||||||||

| How do I open & manage my account? | Eligibility:

How to open the account:

Minimum/Maximum Balance:

How to manage the account:

|

||||||||||||

| Can I withdraw money? | Yes, you have instant access to your account. You can make as many fee free withdrawals as you like. |

||||||||||||

| Additional Information | A 14 day cancellation period applies to this account. We do not deduct tax from any interest paid to you. Tax benefits depend on individual circumstances and could change in the future. Definitions * AER stands for Annual Equivalent Rate. This shows you what the gross rate would be if interest were paid and compounded each year. * Gross is the rate of interest paid before any tax (where applicable) has been deducted. Information correct as of 18 November 2024 |

Probably you! You just need to be a UK resident and hold a first direct 1st Account, our current account.

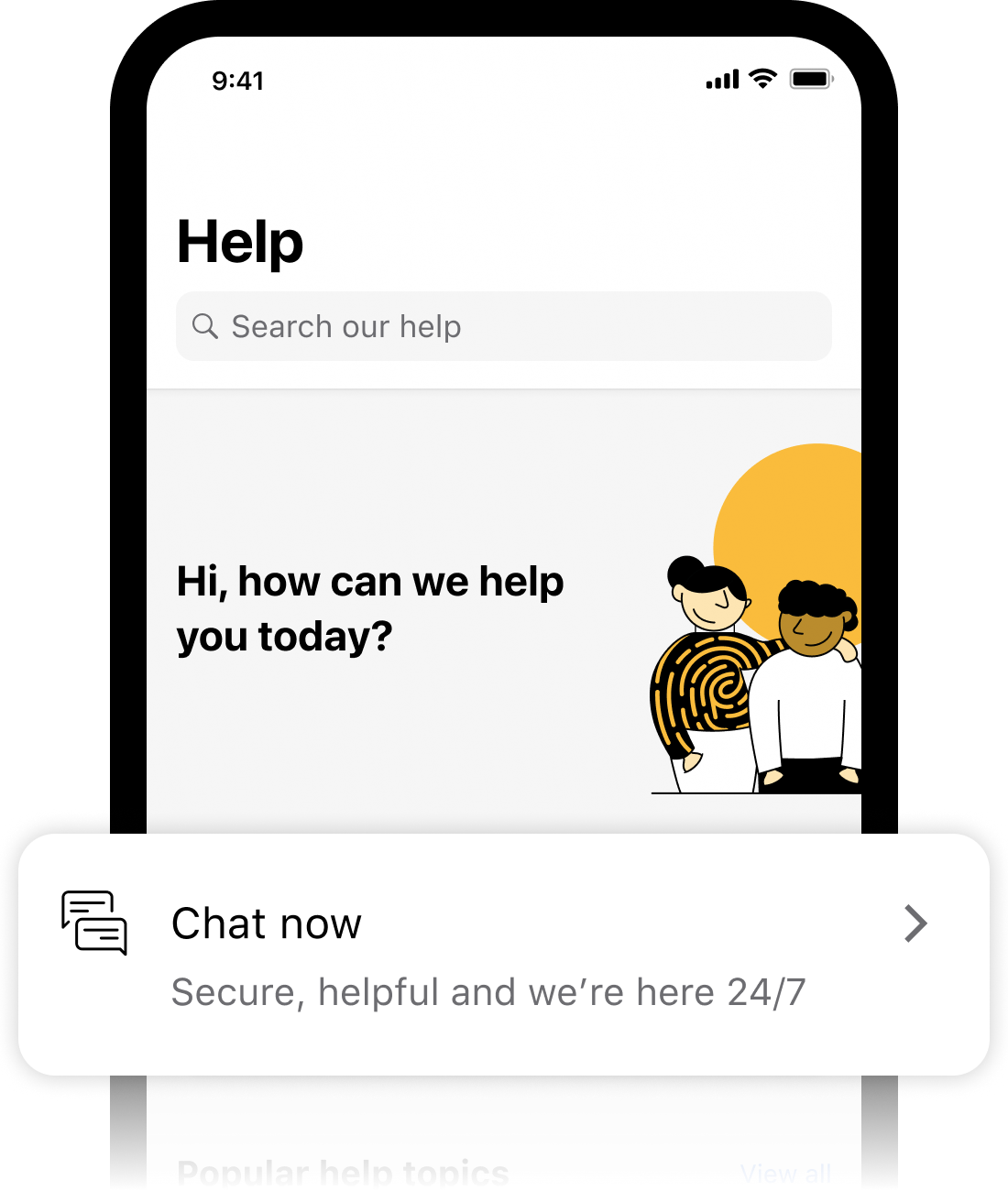

The easiest way to apply for a sole account is through our first direct App.

Just log on, open the chat through the 'Help' tab and type:

"Open a new savings account"

Dot the Chatbot will talk you through the rest.

Scan the QR code to get started on the App

New to first direct? You need to be a 1st Account holder to get access to this product. Find out more about our 1st Account.

For Joint Savings Accounts, give us a call on 03 455 873 967.

Your eligible deposits with HSBC UK Bank plc are protected up to a total of £85,000 or up to £170,000 for joint accounts, by the Financial Services Compensation Scheme, the UK's deposit guarantee scheme.

This limit is applied to the total of any deposits you have with the following: HSBC UK Bank plc and first direct. Any total deposits you hold above the limit between these brands are unlikely to be covered.