How long will it take to get a decision?

It takes less than 10 minutes to apply in our App or online. You hit submit and, if you're accepted, the money is transferred to your account straight away.

If you apply by phone, we still make an instant decision - but it will take longer to get the money if you're accepted. We'll post a loan agreement form for you to sign and send back to us. As soon as we get it back, we'll transfer the money into your 1st Account.

Sometimes we’ll need to take a closer look at your application before agreeing to the loan. If that's the case, we’ll let you know and ask you to get in touch if you haven’t heard from us within 48 hours.

How quickly will I get the money?

If you apply in our App or online and it's also approved online, your loan will be transferred into your first direct 1st Account immediately, so you can put your plans into action straight away. If you apply for your loan over the phone and it's approved, it takes a little longer. We'll post a loan agreement form for you to sign and send back to us. As soon as we receive this signed form, we'll transfer the money into your 1st Account.

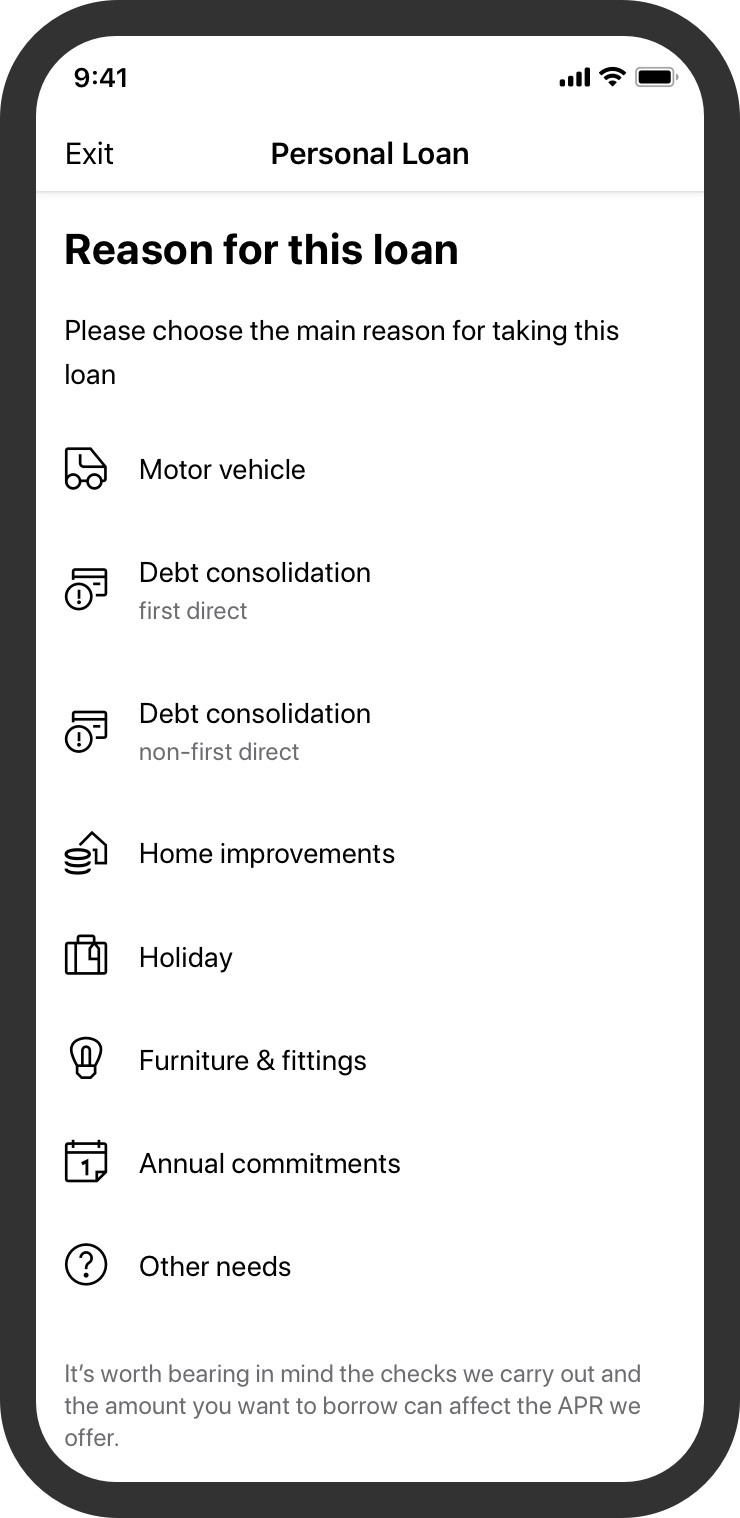

Is there anything that I can't use my loan for?

You can use our loan for lots of things - if you do build a robot dog, we'd love to see it.

There are some things we don't offer loans for:

- buying property or land in or outside the UK - including holiday homes and apartments

- buying a joint stake in a property

- buying out a joint owner

- a mortgage deposit (regardless of the lender or country)

- gifting funds to support the purchase of a property, including mortgage deposits, stamp duty and solicitors' fees

A Personal Loan shouldn't be for gambling, business purposes or sharedealing either. This list isn't exclusive but you can give us a call if you'd like clarification on 03 456 100 199** from 08:00 to 22:00, 7 days a week.

Can I use my loan to consolidate debt?

Yes, as long as it's legal and not for business use. But if you're using some or all of the money to pay off, reduce or combine other borrowing, you should make sure it's right for you before going ahead.

Can I repay the loan early?

Of course. You can repay your loan in full at any time by giving us notice - either by calling us on 03 456 100 199**, sending a message from the Mobile Banking App or Online Banking, or in writing. We'll give you a settlement figure, and as long as you pay this in full, we can close your loan account. If you choose to repay your loan early, there could be a reduction in the amount of interest you have to pay, and this will be reflected in your settlement figure.

Are there any charges for settling early?

Yes, for loans with a 12 month term, we will include a charge of 28 days’ interest as part of your final settlement figure.

For loans with a term of 13 - 96 months there will be an extra 1 month’s charge, plus 28 days interest, as part of your final settlement figure.

You'll then have 28 days to pay this. After this 28 day period you'll need to ask us for a new figure as the amount will change.

How can I find out what my outstanding balance is?

For your current balance and/or a settlement figure, just call us on 03 456 100 199** or send us a message via Online Banking or the Mobile Banking App.

Can I make overpayments?

Yes, you can make overpayments and these could reduce the amount of interest you pay over the term of the loan.

Do I have to be a first direct customer to take out this loan?

Yes, our Personal Loan is only available to first direct Current Account customers and payments are taken by direct debit from your 1st Account. You can find out more about opening a current account.

Do you offer any other types of loan? Secured, flexible or business loans?

Not right now, no. The first direct Personal Loan is an unsecured loan account with fixed monthly repayments.