Who can apply?

To get a Fixed Rate Savings Account, you must hold a first direct current account. You must also be a UK resident and be at least 18 years old. Both sole and joint accounts are permitted.

You can relax knowing exactly how much interest you’ll earn and when – just one reason to fix your savings

Who can apply?

To get a Fixed Rate Savings Account, you must hold a first direct current account. You must also be a UK resident and be at least 18 years old. Both sole and joint accounts are permitted.

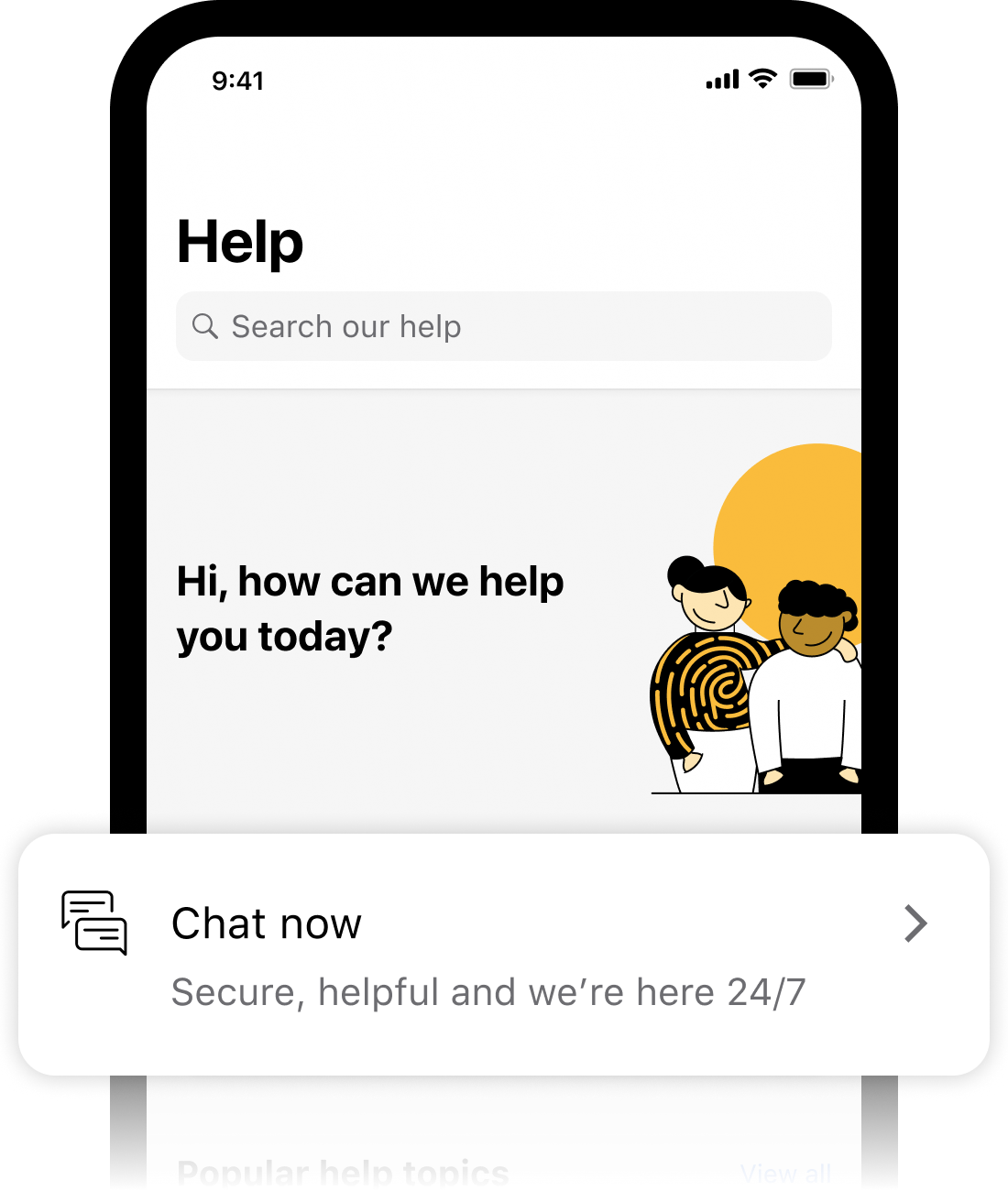

The easiest way to apply is through our Chat in the first direct App.

Just log on, open the chat through the 'Help' tab and type:

"Open a new savings account"

Dot the Chatbot will talk you through the rest.

Scan the QR code to get started on the App

For joint accounts give us a call on 03 455 873 967.

New to first direct? You need to be a 1st Account holder to get access to this product.

Useful information

Dive into fixed rate savings Account details - Account Terms and Conditions and Charges (PDF, 111KB)

What first direct do with your account information- Privacy Notice (PDF, 63KB)

Take a look at a detailed breakdown of interest rates linked to your savings account - Interest Rate and Charges (PDF, 126KB) (For 1st Account charges refer to Account Terms and Conditions and Charges)

Financial Services Compensation Scheme Information Sheet and Exclusions List - UK FSCS Information Sheet and Exclusions List (PDF, 44KB)

Your eligible deposits with HSBC UK Bank plc are protected up to a total of £120,000 or up to £240,000 for joint accounts, by the Financial Services Compensation Scheme, the UK's deposit guarantee scheme.

This limit is applied to the total of any deposits you have with the following: HSBC UK Bank plc and first direct. Any total deposits you hold above the limit between these brands are unlikely to be covered.