If you’re overdrawn for most of the month over a 3-month period or more, we’d see this as regular overdraft use.

Money Management

We're here to help you to improve your everyday spending habits and enjoy a healthier relationship with your money.

Three steps to improving your money management

1. Know how much money you have coming in

It might sound obvious, but the first step in creating a budget is to understand exactly how much money you have coming in each week or month. Plus, any other regular income such as any benefits you might be getting.

If you have a joint income, include theirs too.

2. Work out your monthly spending

Your monthly spending should be separated into two groups - needs and wants.

Needs include things like rent or mortgage payments, groceries, energy bills, travel costs and childcare.

Wants might include the cost of a night out, a new outfit or something nice for the house.

Budgeting is not about denying yourself the occasional treat. But it helps you to identify areas where you might be overspending and could make cut backs.

3. Create your monthly budget

Once you have a clear picture of how much money is going in and out of your account each month, you can work out the difference between the two.

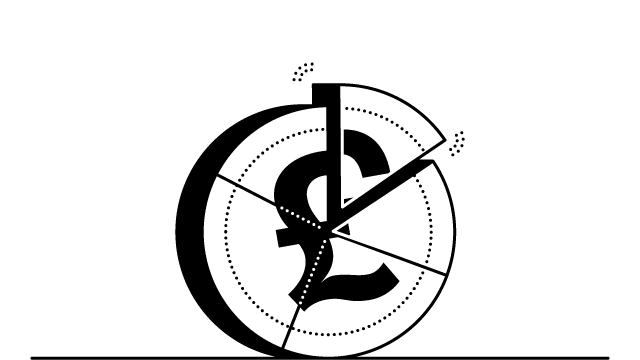

You might find it useful to apply the 50:30:20 rule to help create your budget.

According to this technique, 50% of your income should be spent on your needs, 30% can be spent on your wants and 20% should be left over for savings or repaying any outstanding debts.

Tools you can use

At first direct we offer a range of free tools to help you to build your confidence in money management.

Spending insights

Our spending insights tool is available in the first direct App to help you to get a clearer view of exactly where your money goes each month.

Online webinars

Our colleagues at HSBC run a regular series of free online webinars to give customers the insights they need to budget more effectively and meet their financial goals.

Creating a savings plan

Starting a savings habit, even if it’s a really small amount, is a good step towards having a positive relationship with your finances.

Finding the right savings account for you

Ready to open a savings account? Take a look at our comparison tool to find the best account to match your saving style.

Guide to building an emergency fund

Whether you’ve got unexpected bills to pay or your car has broken down, having an emergency fund can be pretty handy.

10 tips to make your money go further

We've put together a list of savings tips to help your bank balance look better this year.