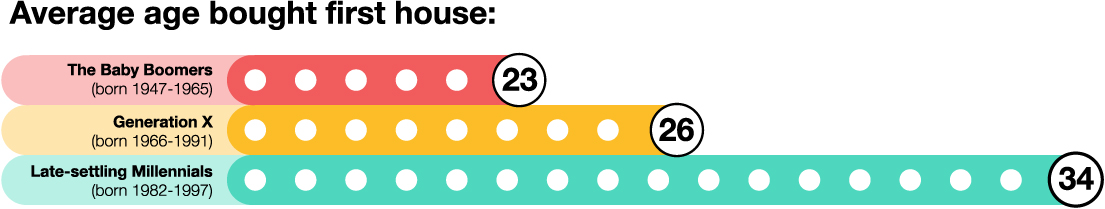

We’ve done some research into what causes generational differences and mapped the personal finance journeys of four generations.

Just over 4,000 people aged 16 and over answered questions about their life events, loans, personal banking and investments. There were around 1,000 respondents in each generational group: Baby Boomers, Generation X, Millennials, and Gen Z.

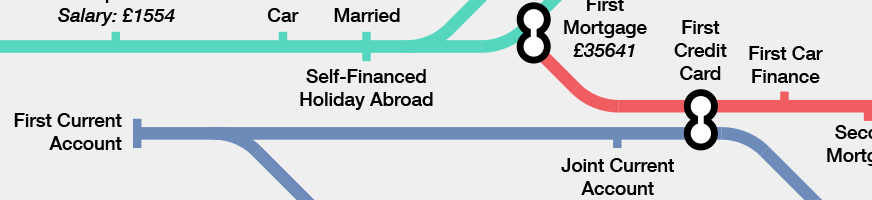

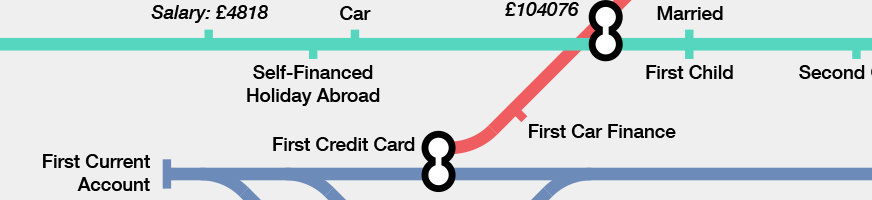

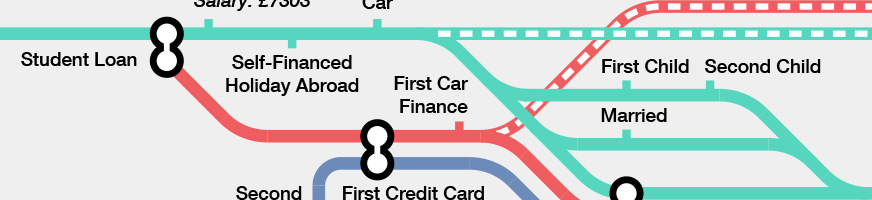

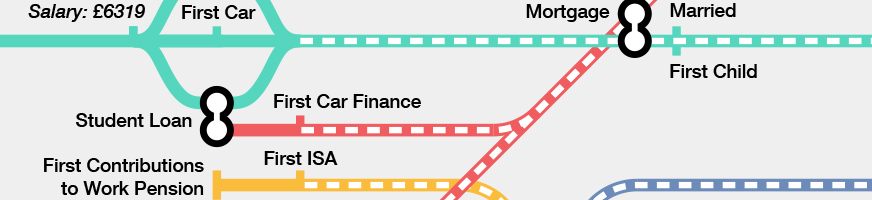

Each generation’s data is shown on a different tube map below…

The main survey question topics are represented by ‘lines’ on our tube maps:

- the Life Events line

- the Loans line

- the Personal Finance line

- the Investments line.

The ‘stations’ on these lines are the average age at which certain milestones happened. The maps also have lines ‘under construction’, representing the milestones that people are expecting to reach.

The Historic Events line runs alongside, starting just before the average birth year in each generation. This line gives context to the personal money milestones, as you can see what was going on in the wider world.

Can you make a healthy comparison between generations?

It’s normal to compare yourself to friends and family, and for them to have expectations of you too. And although comparison isn’t always easy, a balanced discussion across generations can be a healthy thing to do. It could help you learn about different approaches to money and think about what your own financial future looks like.

The important thing to remember is, your views are likely to be biased according to your own financial experiences – so be sure to approach any conversation about money milestones with an open mind and an appetite for understanding.