Personal Savings Allowance

Here's a quick overview of what it means and how it could affect you for the current tax year

What are my options?

The following savings accounts are included in your Personal Savings Allowance:

Regular Saver

If you're working towards a long-term savings goal, our Regular Saver account rewards you for not touching your money.

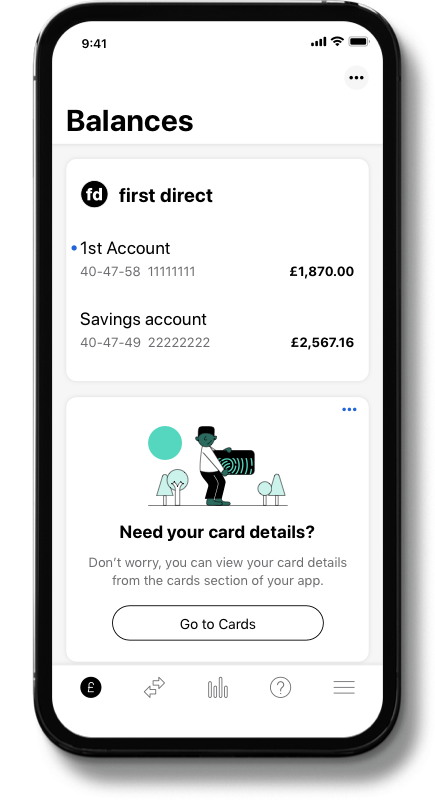

Savings Account

Our standard Savings Account is a flexible option suitable for everyday savers who may need to dip into their funds from time to time.

Bonus Savings Account

A Bonus Savings Account rewards good savings habits with a monthly bonus each month you don't make a withdrawal.

Fixed Rate Savings Account

A Fixed Rate Savings Account allows you to lock away a lump sum for a fixed term of up to 13 months.